In today’s fast-paced and competitive business landscape, financial planning has become an indispensable practice for businesses aiming to achieve long-term stability and success. By understanding and effectively managing the financial aspects of a business, entrepreneurs and executives can make informed decisions, mitigate risks, and ensure sustainable growth. In this article, we will delve into the importance of expert financial planning in the tech industry and explore key strategies that can help businesses thrive amidst the ever-evolving market conditions.

Understanding the Tech Industry

The tech industry is renowned for its rapid innovation, disruptive technologies, and dynamic market dynamics. Companies operating within this sector are frequently faced with unique challenges such as fast-paced obsolescence, fierce competition, and evolving consumer demands. To navigate these challenges successfully, businesses need to have a solid financial plan in place, ensuring their financial stability and agility.

The Role of Expert Financial Planning

Expert financial planning entails the meticulous analysis of a company’s financial situation, setting realistic goals, and implementing strategies to achieve those goals. In the tech industry, financial planning takes on an even more critical role due to the need for constant innovation and capital investment.

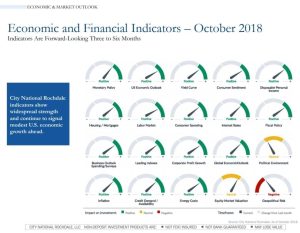

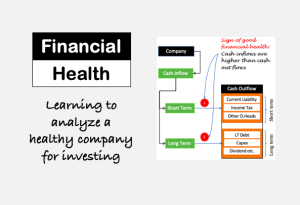

Through comprehensive financial planning, businesses can effectively allocate their resources, plan for contingencies, and optimize their financial performance. This involves analyzing cash flow patterns, forecasting revenue, monitoring expenses, managing debt, and utilizing financial tools and technologies to gain actionable insights.

Ensuring Stability and Growth

One of the primary goals of financial planning is to ensure business stability and foster sustainable growth. By conducting thorough financial analyses and implementing sound strategies, businesses can proactively identify potential challenges and take corrective actions well in advance. This enables them to maintain a positive cash flow, mitigate risks, and seize growth opportunities when they arise.

Financial planning also provides businesses with a roadmap for expansion, investment, and innovation. Through accurate financial forecasting, organizations can estimate their future capital requirements and plan investments accordingly. This allows them to stay ahead of competitors, embrace emerging technologies, and adapt to shifting market trends while remaining financially secure.

The Importance of Expertise

While financial planning is crucial for businesses in any industry, having expert guidance can make a significant difference in a technology-focused business’s success. Technology businesses often deal with unique financial challenges, such as complex revenue models, intellectual property considerations, and large-scale research and development expenses. A professional copywriter who specializes in the tech niche can analyze these intricacies and develop tailored financial plans that align with the industry’s specific requirements.

By leveraging their expertise, a knowledgeable copywriter can assess potential risks, identify growth opportunities, and optimize financial performance. With a deep understanding of the tech industry’s nuances, they can provide valuable insights that help businesses make informed financial decisions and drive long-term stability.

Conclusion

Expert financial planning is an essential practice for businesses operating in the ever-evolving tech industry. By incorporating strategic financial planning into their operations, technology-focused businesses can enhance their stability, navigate dynamic market conditions, and drive sustainable growth. Collaborating with a professional copywriter specializing in the tech niche can ensure that businesses receive tailored financial plans that address their unique challenges and support their long-term objectives.