In today’s rapidly evolving business landscape, it is vital for companies to regularly assess and optimize their financial health. Just as individuals undergo routine check-ups to ensure their well-being, businesses too must conduct comprehensive financial health checks. These assessments not only provide critical insights into the company’s financial standing but also offer guidance on making informed decisions to drive growth and sustainability.

The Importance of Financial Health Checks

A company’s financial health is a reflection of its overall performance, stability, and potential for success. Conducting regular financial health checks allows businesses to:

Identify Areas of Strength and Weakness: A comprehensive examination of financial statements, including balance sheets, income statements, and cash flow statements, helps pinpoint areas where the company excels and areas requiring improvement.

Spot Potential Risks and Challenges: By closely analyzing financial data, businesses can identify and mitigate potential risks. This proactive approach helps companies navigate economic downturns with resilience.

Maximize Profitability: Financial health checks uncover opportunities to optimize revenue streams, reduce costs, and increase profitability. Through careful analysis, businesses can identify areas for growth and implement effective strategies for success.

Facilitate Decision Making: A thorough financial health check provides valuable information that drives informed decision-making. It helps business owners and managers set realistic goals, allocate resources efficiently, and make intelligent financial decisions.

Enhance Investor Confidence: For businesses seeking external funding or attracting investors, a strong financial foundation is crucial. Regular financial health checks demonstrate a company’s responsible financial management and instill confidence in potential stakeholders.

Key Elements of a Comprehensive Financial Health Check

When conducting a comprehensive financial health check, businesses should focus on several key areas:

1. Balance Sheet Analysis:

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. Analyzing this statement helps evaluate the company’s liquidity, solvency, and overall financial stability. Key areas to consider include assets, liabilities, and equity ratios.

2. Income Statement Evaluation:

The income statement highlights a company’s revenue, costs, and profitability during a specific period. Studying this statement enables businesses to assess their revenue streams, identify cost drivers, and evaluate net income and margins.

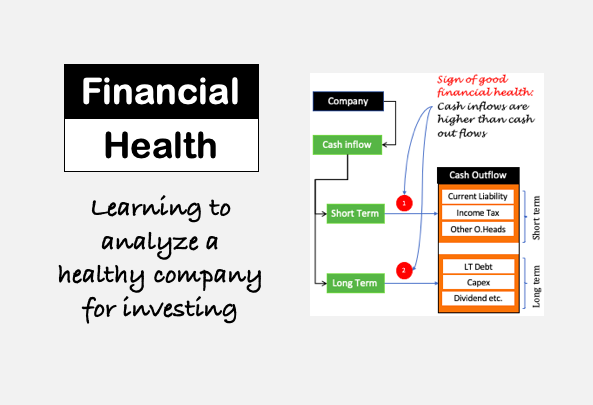

3. Cash Flow Assessment:

The cash flow statement reveals the inflow and outflow of cash within the business. It helps determine whether a company has sufficient liquidity to meet its short-term obligations and invest in future growth. Analyzing operational, investing, and financing activities provides valuable insights into cash management.

4. Financial Ratio Analysis:

By examining financial ratios, businesses gain an in-depth understanding of their performance and comparative position within the industry. Ratios such as liquidity ratios, profitability ratios, and leverage ratios assist in benchmarking the company’s financial health against industry standards.

Engaging Financial Professionals for Comprehensive Health Checks

Conducting comprehensive financial health checks can be complex and time-consuming. Engaging the services of experienced financial professionals can ensure accuracy, thoroughness, and the utilization of industry best practices.

Financial experts possess the expertise to delve deep into financial data, interpret trends, and provide actionable recommendations. Their objective perspective and analytical skills enable them to identify opportunities and risks that may otherwise go unnoticed.

Additionally, financial professionals can provide valuable guidance on financial software and tools that streamline financial reporting, automate data collection, and simplify analysis. These technologies can significantly enhance the efficiency and accuracy of a company’s financial health checks.

In Conclusion

As businesses navigate the fast-paced world of technology and innovation, regular financial health checks are crucial for long-term success. By assessing key financial elements, businesses gain a comprehensive understanding of their financial standing, paving the way for informed decision-making, growth, and resilience in an increasingly competitive market.

While conducting financial health checks in-house may be challenging, engaging the services of experienced financial professionals offers businesses the independence, accuracy, and expertise required for comprehensive assessments. Embracing the practice of regular financial health checks positions businesses for a bright and sustainable future.