Starting a business or expanding an existing one often requires a substantial amount of capital. However, acquiring the necessary funds can be challenging, especially for small businesses or entrepreneurs with limited financial resources. Fortunately, business loans and financing options have made it easier for companies to secure the necessary funding to achieve their goals. In this article, we will explore various aspects of business loans and financing, as well as the available alternatives, to help entrepreneurs make informed decisions.

Understanding Business Loans:

Business loans are financial tools designed specifically for companies and entrepreneurs to obtain capital for various purposes. Whether you need funding for equipment, inventory, marketing, expansion, or even to cover day-to-day expenses, business loans can provide the necessary resources to propel your business forward. Unlike personal loans, business loans typically have different terms, interest rates, and repayment structures, tailored to meet the unique needs of businesses.

The Benefits of Business Loans:

1. Access to Capital: The most obvious advantage of business loans is the access to capital that they provide, allowing you to invest in your business, seize opportunities, and achieve growth.

2. Control and Ownership: Unlike seeking investors or partners, business loans allow you to maintain full control and ownership of your company. You have the freedom to make decisions without diluting your stake.

3. Tax Deductible Interest: In many cases, the interest paid on business loans is tax-deductible, reducing the overall burden on your business.

4. Building Credit: Responsible management of business loans can help establish and improve your business credit, ultimately leading to better financing terms and options in the future.

Types of Business Loans:

1. Traditional Bank Loans:

Traditional bank loans are a popular choice for many businesses. These loans often have competitive interest rates, longer repayment terms, and can be secured or unsecured depending on your creditworthiness.

2. Small Business Administration (SBA) Loans:

SBA loans are backed by the U.S. Small Business Administration, providing more favorable terms to small businesses, including lower down payments, longer repayment periods, and higher borrowing limits.

3. Business Line of Credit:

A business line of credit allows you to access a predetermined amount of funds whenever needed. You only pay interest on the amount withdrawn, providing flexibility and quick access to capital.

4. Equipment Financing:

If your business requires specific equipment, equipment financing can be a great option. This type of loan is secured by the equipment being purchased, making it easier to obtain, even for businesses with limited credit history.

5. Invoice Financing:

Invoice financing, also known as accounts receivable financing, allows you to leverage your unpaid customer invoices by obtaining immediate funding based on their value. This type of financing helps bridge cash flow gaps and reduce the risk of non-payment.

Choosing the Right Business Loan:

When selecting a business loan, several factors need to be considered:

1. Loan Amount:

Understand the exact capital requirement, ensuring that the loan covers your needs without burdening your business with excessive debts.

2. Interest Rates and Fees:

Compare interest rates from different lenders, taking into consideration any origination fees, processing charges, or early repayment penalties. Choose a loan that offers competitive terms that align with your financial capabilities.

3. Repayment Structure:

Consider the repayment structure that suits your business – fixed monthly payments, flexible terms, or aligned with your cash flow patterns.

4. Eligibility Criteria:

Understand the eligibility requirements of each loan option, ensuring that your business meets the necessary criteria before applying.

The Loan Application Process:

When applying for a business loan, it is crucial to have all the required documents and information readily available:

1. Business Plan: Provide a comprehensive business plan outlining your goals, finances, and how the loan will be utilized.

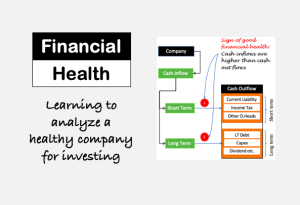

2. Financial Documents: Prepare financial statements, tax records, and bank statements to demonstrate your business’s financial health and ability to repay the loan.

3. Credit History: Maintain a good personal and business credit history, as lenders consider this when evaluating your loan application.

Conclusion:

Business loans and financing options provide entrepreneurs with the means to achieve growth and success. Carefully assess your business’s needs, evaluate the available loan options, and choose a financing solution that aligns with your goals and financial capability.

Remember to maintain open communication with your chosen lender, provide accurate information, and develop a repayment plan that ensures future financial stability for your business.

With the right business loan, your company can thrive and reach new heights!