In today’s fast-paced world, where technological advancements are constantly transforming the way businesses operate, effective cash flow management has become crucial for financial success. Whether you’re an established tech company or a startup, ensuring a healthy cash flow is essential to sustain operations, drive innovation, and achieve long-term growth. In this article, we will explore the significance of cash flow management and provide valuable insights on how to master this essential skill in the tech industry.

The Importance of Cash Flow Management

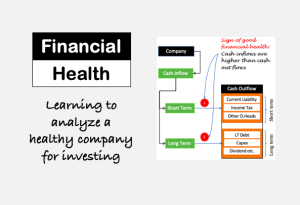

1. Ensuring Stability: Cash flow management allows tech businesses to maintain stability by providing a clear snapshot of their financial health. By carefully monitoring incoming and outgoing funds, companies can better predict and plan for their future activities. This stability enables them to navigate economic uncertainties, sustain day-to-day operations, and withstand any unexpected financial hurdles.

2. Managing Costs Efficiently: Effective cash flow management helps businesses identify areas where costs can be minimized. By analyzing the cash flow statement, tech companies can pinpoint unnecessary expenses, optimize resource allocation, and develop strategies to maximize profitability. This proactive approach to cost management fosters long-term sustainability and improves overall financial performance.

3. Securing Investments and Funding: Demonstrating a strong cash flow management system is crucial when seeking external funding or investments. Investors are more likely to support tech companies that exhibit a solid understanding of their financial position, as it reflects a higher probability of returns and overall stability. By effectively managing cash flow, businesses can attract potential investors and secure the necessary funds to drive growth and innovation.

Key Strategies for Effective Cash Flow Management

1. Streamline Accounts Receivable: Implementing efficient billing and invoicing processes is essential for managing cash flow effectively. Tech companies should establish clear payment terms, follow up on overdue invoices, and consider offering electronic payment options to expedite collections. Additionally, utilizing automated financial software can streamline these processes, reducing human error and improving overall efficiency.

2. Manage Accounts Payable: Delaying payments may negatively impact a tech company’s relationships with suppliers and can even lead to interrupted supply chains. By staying on top of accounts payable, businesses can maintain strong partnerships, negotiate favorable terms, and build a reputation as reliable payers, ensuring the uninterrupted flow of goods and services.

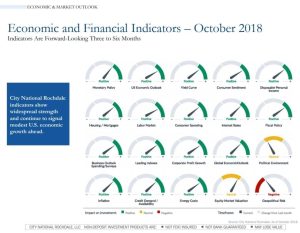

3. Forecasting and Planning: Developing accurate cash flow forecasts allows tech businesses to anticipate potential gaps and plan accordingly. By analyzing historical data and considering various scenarios, companies can identify peak and low cash flow periods. This knowledge enables proactive measures, such as adjusting expenses, seeking additional funding sources, or negotiating payment terms, to bridge any potential cash shortfalls.

4. Utilize Technology: In the tech industry, leveraging technology is essential for efficient cash flow management. Implementing robust financial management software can automate various processes, including accounts receivable, accounts payable, and financial reporting. This digital integration not only saves time and reduces errors but also provides real-time visibility into cash flow, facilitating informed decision-making.

The Role of Cash Flow Management in Tech Startups

For tech startups, effective cash flow management is even more critical. With limited resources and often relying on investments or funding rounds, startups must meticulously plan and track their cash flow to avoid running out of runway. By actively managing cash flow, startups can demonstrate financial discipline to potential investors, improve their chances of securing follow-on funding, and increase their runway for growth and product development.

Conclusion

In the competitive tech industry, cash flow management is a crucial element for long-term financial success. By proactively monitoring and managing cash flow, businesses can enhance stability, improve cost management, attract investments, and position themselves for sustainable growth. Adopting efficient billing and payment processes, leveraging technology, and utilizing accurate forecasting strategies are key to mastering this essential skill. By making cash flow management a priority, tech companies can effectively navigate financial challenges, seize opportunities, and drive innovation in the ever-evolving technology landscape.